Étiquette : canons

Shakespeare’s lesson in Economics

Cet article en FR

by Karel Vereycken

As early as 1913, the very year that a handful of major Anglo-American banks set up the Federal Reserve to prevent that any form of national bank in the US fixes the rules for money and credit, Henry Farnam 1 , an economist at Yale University, noted that « if one examines the dramas of Shakespeare, one will notice that quite often in his plays the action turns entirely or partly on economic questions. »

The comedy The Merchant of Venice (circa 1596) is undoubtedly the most striking example. While the plot of the story is generally well known, the deeper meaning of this play, which can be read on different levels, is often overlooked. The sequence of events (the story itself) is one, what they reveal (the principles) is another.

The narrative

To help out his protégé Bassanio and enable him to engage with his beloved Portia, a Catholic Venetian merchant and shipowner named Antonio borrows money from a Jewish moneylender, Shylock.

Shylock hates Antonio, the very archetype of the hypocritical Christian, because the latter treats him with contempt. Antonio, on the other hand, hates Shylock because he is Jewish and because he is a usurer: he lends at interest.

Shakespeare makes us understand that the prosperity of Venice is based on the mutual hatred fueled by the oligarchs between Jews and Christians, according to the famous principle of « Divide and rule. » 2

Double-dealing

The Venetian oligarchy never lacked imagination in circumventing the standards it imposed on its adversaries.

Indeed, among both Jews and Christians, financial usury is condemned and even punished. Interest, which is simply defined as the remuneration of a creditor by his debtor for having lent him capital, is a very ancient concept that probably dates back to the Sumerians and is also found in other ancient civilizations such as the Egyptians or the Romans.

Now, let us recall here that Judaism, which is the first of the Abrahamic religions, clearly prohibits lending at interest. We encounter numerous passages that condemn interest in the Torah, such as the book of Exodus 22:25-27, Leviticus 25:36-37 and Deuteronomy 23:20-21.

However, this prohibition only applies to loans within the Jewish community. In Deuteronomy 23:20-21, it is stated that

« When you lend money, food, or anything else to a fellow countryman, you shall not charge him interest. You may charge interest when you lend to a foreigner, but you shall not lend at interest to your fellow countrymen. »

Initially, the same rule applied among Christians. It was not until the First Council of Nicaea (in 325) that lending at interest was prohibited. At the time, many churches were held by lineages of priests , just as nearby castles were controlled by lineages of lords, the two often being related. While its condemnation had been relatively mild in Christianity before then, interest became a serious sin and was heavily punished from the 1200s onwards.

The exploitation of Jews

Italy has been home to Jews since ancient times. They were dependent on popes, princes, or merchant republics. Rome, Sicily, and the Kingdom of Naples had large communities, and popes sometimes hired Jewish doctors. In the 13th century, some cities granted Jewish bankers, with papal license, a monopoly on pawnbroking.

Venice welcomed Jews but forbade them from practicing any profession other than lending for interest. Initially, the Jews publicly enriched themselves in Venice, drawing the ire of the rest of the population.

To « protect » the Jews, the Doge of Venice created the first ghetto (a Venetian word), offering, it must be said, the most unsanitary district of the lagoon to these Jews whom he detested while cherishing the financing they provided for Venetian colonial expeditions and the slave trade that « Catholic » Venice practiced without any qualms.

The Merchant of Venice

This is the essence of the Venetian system that Shakespeare unmasks in his comedy The Merchant of Venice . 3

So, when Antonio goes to ask Shylock for a loan of 3000 ducats for a period of three months, he first tells him:

« Shylock, I normally don’t lend or borrow money with interest, but in order to help my needy friend, I’ll break my custom. » 4

Shylock then replies:

« Sir Antonio, many times you have criticized me about my money and habit of charging interest in the Rialto. I have endured it all with patience and a shrug, because we Jews are known for our ability to endure. You say I believe in the wrong religion, call me a cut-throat dog, and spit on my Jewish clothing, all because I use my own money to make profit. And now it appears that you need my help. Okay, then!

You come to me and you say, « Shylock, I need money. » You tell me this! You who spat on my beard and kicked me as you’d kick a stray dog away from your threshold! You ask for money. What should I say to you? Shouldn’t I say, « Does a dog have money? Is it possible for a dog to lend you three thousand ducats? » Or should I get bend to my knees and with bated breath humbly whisper, « Fair sir, you spat on me last Wednesday; you spurned me then; another time you called me a dog—and for all this courtesy you’ve shown me, I will gladly lend you this much money? » 5

To which Antonio retorts:

« I am likely to call you such names again, spit on you again, and spurn you, too. If you decide to lend this money, don’t do it as if we are your friends. After all, when have friends ever charged each other interest? Lend me the money as your enemy and if I break my part of the agreement you can more happily punish me. » 6

Offended, Shylock replies:

« Why, look at your temper! I would be friends with you and have your affection, forget about how you have shamed me, lend you what you need and take no interest—but you won’t listen to me! I’m giving you a kind offer. » 7

Shylock, to escape from the mutual hatred, offers to lend him (according to the Jewish and Christian rule), as a friend, without interest.

But the « good » Catholic Antonio refuses to become friends with the Jew. He asserts that in business, one should not have friends , and demands that he lend to him as an enemy because it is easier to sanction in case of non-compliance with the contract.

As Churchill said, an empire has no friends, only interests. This principle would later be theorized by Nazi crown jurist Carl Schmidt to become the rule of today’s oligarchy: to exist, one needs an enemy, and if you lack one, hurry up to invent one!

The Venitian’s double game

As we can see, Shakespeare points out the hypocrisy of this Venetian system which bases its prosperity on a « win-win » policy, not between friends, but as a cynical game between concurring mafias.

Let us recall here that, although it was regularly at war with the Turks, Venice also created a ghetto for Turkish merchants and even a « Foundation », that is to say a functional trade representation in the city.

If a Venetian ambassador was reproached for this trade with the Ottomans which threatened the West, he would reply: « As merchants, we cannot live without them. »

The Ottomans sold wheat, spices, raw silk, cotton, and ash (essential for glassmaking) to the Venetians, while Venice supplied them with finished products such as soap, paper, textiles, and… weapons. Although this was explicitly forbidden by the Pope, countries as France, England, the Low Countries, but especially Venice, Genoa, and Florence sold firearms and gunpowder to the Levant and the Turks. 8

Venice supplied the Turks with cannons and military engineers with its left hand, while renting ships at high prices to Christians who wanted to fight them with its right hand. Added to this was the rivalry with Genoa, which had allied itself with the Palaeologus dynasty but which the Ottomans defeated in favor of the Venetians.

In 1452, a year before the fall of Constantinople, the Hungarian engineer and founder Urban (or Orban), a specialist in large bombards, entered the service of the Ottomans. These cannons, he entrusted to the Sultan, were so powerful that they would bring down « the walls of Babylon. » We know what happened next in 1453.

When the Franks wanted to hire ships in Venice to go on crusade, they lacked money.

No problem: Venice finds the right arrangement. To pay for the ships’ rental, the Franks are invited to make a small detour along the route and begin the crusade by liberating Constantinople, which Venice wants to retake from the Ottomans. And it works! Venice increases its trading posts and military bases in Constantinople to expand its financial and commercial empire.

A Pound of Flesh

Faced with Antonio’s foolish and arrogant response, Shylock pushes his logic to the point of absurdity and, jokingly, suggests that if his debtor does not repay his debt on time, he would have the right to take a pound of flesh from him.

This can be seen as a literal and wacky interpretation of what was written on the « bonds » or « receipts of debt » of the time. Antonio, who is convinced that his ships will return to Venice in time to provide him with enough to repay Shylock, accepts the terms of the contract, almost laughing at their surreal nature.

This is where Shakespeare poses a fundamental question and offers us a beautiful lesson in economics, in the form of a tragic and paradoxical metaphor. In most ancient civilizations, failure to repay a debt could lead you to slavery, cost you your life, or send you to prison for the rest of your life. From monetary slavery, we thus moved on to physical slavery. 9

Later, for example, we find in the archives of the Antwerp courts the text of a trial in 1567 concerning an obligation between Coenraerd Schetz and Jan Spierinck:

« I, Jan Spierinck, confess and declare with my own hand that I owe the honorable Lord Coenraerdt Schetz the sum of four hundred Flemish pounds, and this on the basis of the equal sum that I have received from him to my satisfaction. I promise to pay in full the said Lord Coenraerdt Schetz or the bearer of this present, on the fourth day of the next month of August without any delay, by pledging myself and all my property now and in the future. In the year 1565, on the 11th of June. »

You read that right: « by pledging myself. » Taken literally, the debtor pledges his person as surety to his creditor. Let us also recall that in France, imprisonment for private debts was instituted by a royal ordinance of Philip the Fair in March 1303. Apart from two periods of abolition, from 1793 to 1797 and in 1848, the imprisonment of debtors persisted in France until its abolition in 1867.

During the Renaissance, the Christian humanism of Petrarch, Erasmus, Rabelais, and Thomas More combined Socrates’ notion of justice with that of love for others, and a new principle emerged: the life of each individual is sacred and has a value immeasurably greater than any financial debt.

It is a questioning of this principle that turns Shakespeare’s comedy into a drama. Little by little, the spectator learns that Antonio’s ships have all been swept away by storms and other misfortunes. He therefore does not have the necessary means to repay his debt in time.

The Merchant of Venice must therefore accept that Shylock takes a pound of flesh from him as stipulated in the debt title he signed… a financial claim duely validated by a notary and the laws of the Venetian Republic.

To save Antonio’s life, his friends then offer the lender double the initial sum borrowed, but Shylock, driven by a sense of revenge, will not listen, angry moreover at the fact that his daughter has left his house with a young Christian merchant, taking with her a tidy sum of ducats and family jewels.

Shylock viciously responds to the Doge’s request to show mercy, saying that he is asking for nothing more… than the application of the law. He also reminds the Venetians that they are in no position to give moral lessons, because in Venice one can « buy » people:

« What judgment shall I dread, doing no wrong? You have among you many a purchased slave, Which—like your asses and your dogs and mules— You use in abject and in slavish parts. Because you bought them. Shall I say to you, “Let them be free! Marry them to your heirs! Why sweat they under burdens? Let their beds Be made as soft as yours and let their palates Be seasoned with such viands”? You will answer, “The slaves are ours.” So do I answer you. The pound of flesh which I demand of him Is dearly bought. ‘Tis mine and I will have it. If you deny me, fie upon your law— There is no force in the decrees of Venice. 105 I stand for judgment. Answer, shall I have it? » 10

To this, the impotent Doge offers no counterargument. He himself must obey the laws of the city. The only thing he has the right to do is to allow a doctor of law who has examined the case to deliver his expert opinion.

Turnaround of the situation

Here Shakespeare introduces Portia, who, disguised as a law doctor and acting in the name of a higher principle, love for humanity and good, will succeed in turning the tide. 11

Having acknowledged the validity of Shylock’s claim, she turns the tables with the kind of audacity we lack today. Regarding the claim, she notes an important detail concerning the implementation of the sanction:

« Hold on a second. There’s something else. This agreement doesn’t give you any drop of blood. The literal words are « a pound of flesh. » So take what is yours, take your pound of flesh, but if in cutting it off you shed one drop of Christian blood, your lands and goods will be confiscated by the state of Venice by the city’s laws. » 12

This is another beautiful lesson Shakespeare teaches us. How many excellent laws are worthless simply because their authors didn’t bother to specify their implementation? Do you know the laws that allow you to defend yourself against the injustices the system inflicts on you? Because if the devil is in the details, the good Lord is sometimes not far away. It’s up to you to go and find him.

Shakespeare reminds us that economics is not limited to law and mathematics. Every economic choice remains a societal choice. In reality, only « political economy » should be taught in our universities and theaters.

Presenting the science of economics and finance as an « objective » reality and not as a reality of human choices is the best proof that we are subject to propaganda.

In conclusion, let us emphasize that unlike Christopher Marlowe‘s play, The Jew of Malta (circa 1589), the main actor in Shakespeare’s play is not the evil Jew Shylock (as claimed by anti-Semites who performed distorted versions of the play during the dark periods of our history), but rather the very Catholic merchant of Venice who, as we have seen, uses the Jews for his own interests. Let us recall that in the Jewish ghetto of Venice, the Jews were only allowed to deal with finance but nothing else…

Finally, in The Merchant of Venice , Shakespeare unmasks the workings of a mad and criminal finance which knows how to use formal interpretations of law (the appearance of justice) to satisfy its greed (true injustice).

NOTES:

- Henry Farnam, Shakespeare as an economist, p. 437, Yale Publishing Association, New Haven; ↩︎

- See Sinan Guven, The Conflict Between Interest and Abrahamic Religions , HEConomist, the student newspaper; ↩︎

- All the following quotes from Shakespeare’s The Merchant of Venice are taken from the website Litcharts; ↩︎

- Act 1, Scene 3; ↩︎

- Act 1, Scene 3; ↩︎

- Act 1, Scene 3; ↩︎

- Act 1, Scene 3; ↩︎

- Salim Aydoz, Artillery Trade of the Ottoman Empire, Muslim Heritage website, Sept. 2006; ↩︎

- A case in point is the history of Haiti. See Invade Haiti, Wall Street urged, New York Times, 2022. ↩︎

- Act 4, Scene 1; ↩︎

- The principle of a « Promethean » woman intervening disguised as a man for the good of humanity will be, with the person of Leonore, at the center of Fidelio, Beethoven’s unique opera; ↩︎

- Act 4, Scene 1; ↩︎

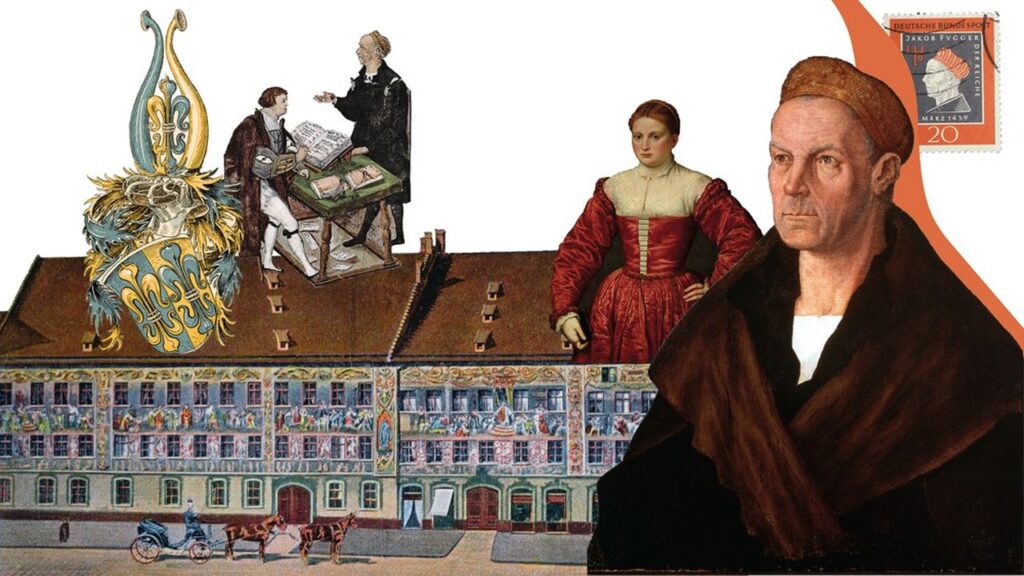

Jacob Fugger « The Rich », father of financial fascism

By Karel Vereycken, September 2024.

Lire cet article en FR

Investigation the Fugger and Welser banking houses?

In 1999, a dumb Bill Clinton, in front of an audience of hilarious American bankers, repealed the famous Glass-Steagall Act, the law adopted by Franklin Roosevelt to pull the world out of the economic depression by imposing a strict separation between investment (speculative) banks and the “normal” banks responsible for providing credit to the real economy.

In Orwellian fashion, the 1999 law sealing this repeal is called the Gramm-Leach-Bliley “Financial Services Modernization Act”. However, as you will discover in this article, this law, which opened the floodgates to the current predatory and criminal financial globalization, merely re-established feudal practices that had been pushed back with the dawn of modern times.

In France, the program of the Conseil national de la Résistance (CNR) explicitly called for “the establishment of a genuine social and economic and democracy, involving the removal of the great economic and financial feudal powers from the direction of the economy”, a demand echoed, in part, in the 9th paragraph of the preamble to the French 1946 Constitution, which states that “All property and all enterprises –the operation of which has or acquires the characteristics of a national public service or a monopoly in practice– must become the property of the collectivity”.

In this sense, the urgent “modernization” of finance for which we are fighting, aims to recreate not just a block of public banks, but real sovereign “national banks” (as opposed to “independent” central banks) under government control, each serving its own country but working in concert with others around the world to invest in physical and human infrastructure to the greatest benefit of all. By creating a productive credit system and “organized markets,” we can escape the hell of a feudal “monetarist” blackmail system.

To assert today that an international cartel of counterfeiters is seeking to take control of democratic societies, to engage in colonial plunder, to create fratricidal dissensions and the conditions for a new world war, will immediately be branded as conspiracy theory, Putinophilia or concealed anti-Semitism, or all three at once.

Yet the historical facts of the rise and fall of the German Fugger and Welser families (who were ardent Catholics), amply demonstrate that this is precisely what happened in the early XVIth century. Their rise and power was a veritable stab in the back of the Renaissance. Today, it’s up to us to “modernize” finance to make sure that such a situation never arises again!

Bribery and elections

In the « good old days » of the Roman Empire, things were so much simpler! Already in Athens but on a much larger scale in Rome, electoral bribery was big business. In the late Republic, lobbies coordinated schemes of bribery and extortion. Large-scale borrowing to raise money for bribes is even said to have created so much financial instability that it contributed to the 49–45 BC civil war. Roman generals, once they had systematically massacred and looted some distant colony and sold for hard cash their colonial loot, could simply buy the required number of votes, always decisive to elect an emperor or endorse a tyrant after a coup d’Etat. Legitimacy was always post-factum those days.

In Rome, the “elections” became an obscene farce to the point that they were eliminated. “A blessing from heaven”, said the statesman Quintus Aurelius Symmachus, rejoicing that “the hideous voting tablet, the crooked distribution of the seating places in the theater among the clients, the venal run, all of these are no more!”

The Holy Roman German Empire

Reviving such a degenerate and corrupt imperial system wasn’t a bright idea. On 25 December 800, Pope Leo III crowned Charlemagne as Roman emperor, reviving the title in Western Europe more than three centuries after the collapse of the ancient Western Roman Empire in 476 DC.

In 962 DC, when Otto I was crowned emperor by Pope John XII, he fashioned himself as Charlemagne’s successor, and inaugurated a continuous existence of the empire for over eight centuries. In theory the emperors were considered the primus inter pares (“first among equals”) of all Europe’s Catholic monarchs. In practice, the imperial office was traditionally elective by the mostly German prince-electors.

Just as the vote of the Roman Senate was necessary to “elect” a Roman Emperor, in the Middle Ages, a tiny group of prince-electors had the privilege of “electing” the “King of the Romans.” Once elected in that capacity, this elected king would then be crowned Emperor by the pope.

The status of prince-elector had great prestige. It was considered to be behind only the emperor, kings, and the highest dukes. The prince-electors held exclusive privileges that were not shared with other princes of the Empire, and they continued to hold their original titles alongside that of prince-electors.

In 1356, the Golden Bull, a decree carrying a golden seal, issued by the Imperial Diet at Nuremberg and Metz headed by the Emperor of that time, Charles IV, fixed the protocols and rules of the imperial power system. While limiting their power, the Golden Bull granted the great-electors the Privilegium de non appellando (“privilege of not appealing”), preventing their subjects from lodging an appeal to a higher Imperial court, and turning their territorial courts into courts of last resort.

However, imposing such a superstructure everywhere was no mean feat. With Jacques Cœur, Yolande d’Aragon and Louis XI, France increasingly asserted itself as a sovereign, anti-imperial nation-state.

Therefore, the Holy Roman Empire, by a decree adopted at the Diet of Cologne in 1512, became the “Holy Roman Empire of the Germanic Nation,” a name first used in a document in 1474. The adoption of this new name coincided with the loss of imperial territories in Italy and Burgundy to the south and west by the late XVth century, but also aimed to emphasize the new importance of the German Imperial Estates in ruling the Empire. Napoleon was supposedly the one who said the Holy Roman German Empire was triply misnamed and none of the three. It was “too debauched” to be holy, “too German” to be Roman and “too weak” to be an Empire.

In light of the object of this article, we will not expand here on this subject. Noteworthy nevertheless, the fact that German Nazi Party propaganda, as early as 1923, would identify the Holy Roman Empire of the Germanic Nation as the « First » Reich (Reich meaning empire), with the German Empire as the « Second » Reich and what would eventually become Nazi Germany as the « Third » Reich.

Hitler had a soft spot for Fugger’s hometown Augsburg and wanted to make it the “City of German Businessmen”. To honor the Fugger family, he wanted to convert their Palace into a huge trade museum. To break the Fuhrer’s moral, the building got severely bombed in February 1942.

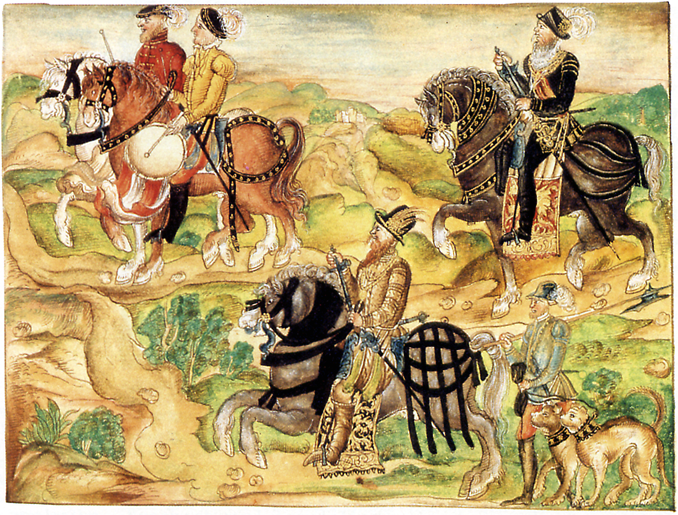

The Prince Electors

By the XVIth Century, the Holy Roman Empire consisted of 1,800 semi-independent states spread across Central Europe and Northern Italy. In a nod to the ancient Germanic tradition of electing kings, the medieval emperors of this sprawling patchwork of disparate territories were elected

What we do know is that, from the Golden Bull of 1356 onward, the emperor was elected in Frankfurt by an “electoral college” of seven “Prince-electors” (Kurfürst in German):

- the archbishop of Mainz, arch-chancellor of Germany;

- the archbishop of Trier, arch-chancellor of Gallia (France);

- the archbishop of Cologne, arch-chancellor of Italy;

- the duke of Saxony;

- the count palatine of the Rhine;

- the margrave of Brandenburg;

- and the king of Bohemia.

Of course, to obtain the vote of these great electors, candidates had to deliver oral and in advance written promises and engagements, and especially, on (and under) the table, offer privileges, power, money and more.

Hence, the most difficult endeavor for any aspiring candidate, was to raise the bribery money to buy the votes. As a result, the very existence and survival of the Holy Roman German Empire, depended nearly entirely on the existence, survival and especially goodwill of a financial oligarchy of wealthy merchant banking families willing to lend the money to the bribers. Just as a handful of giant banks are controlling western nations today by buying their emissions of state bonds required to bail-out and refinance permanent but growing debt bubbles, the banking monopolies of those days became very rapidly too-big-to-fail and too-big-to-jail.

The financial power and influence of the Bardi, Peruzzi and other Medici bankers, who, by ruining the European farmers plunged Europe in great famine creating the conditions for the XIVth Century’s “Black Death” wiping out between 30 and 50 percent of the European population, is no secret and has been aptly documented by a friend of mine, the American financial analyst, Paul Gallagher.

Fucker Advenit

Here, we’ll focus on the activities of two German banking families who dominated the world in the early XVIth century: the Fuggers and the Welsers of Augsburg.

Unlike the Welsers, and old patrician family about we will say more later, the Fugger’s’ success story begins in 1367, when “master weaver” Hans Fugger (1348-1409) moved from his village of Graben to the “free imperial city” of Augsburg, a four-hour walk away. The Augsburg tax register reads “Fucker Advenit” (Fugger has arrived). In 1385, Hans was elected to the leadership of the weavers’ guild, which gave him a seat on the city’s Grand Council.

Augsburg, like other free and imperial cities, was not subject to the authority of any prince, but only to that of the emperor himself. The city was represented at the Imperial Diet, controlled its own trade and allowed little outside interference.

In Renaissance Germany, few cities matched Augsburg’s energy and effervescence. Markets overflowed with everything from ostrich eggs to saints’ skulls. Ladies brought falcons to church. Hungarian cow-boys drove cattle through the streets. If the emperor came to town, knights jousted in the squares. If a murderer was arrested in the morning, he was hanged in the afternoon for all to see. Beer flowed as freely in the public baths as it did in the taverns. The city not only authorized prostitution, it also maintained brothels

Initially, the Fugger’s commercial profile was very traditional: fabrics made by local weavers were bought and sold at fairs in Frankfurt, Cologne and, over the Alps, Venice. For a weaver like Hans Fugger, this was the “ideal time” to come to Augsburg. An exciting innovation was taking hold throughout Europe: fustian, a new type of fabric perhaps named after the Egyptian town of Fustat, near Cairo, which manufactured this material before its production spread to Italy, southern Germany and France.

Medieval fustian was a sturdy canvas or twill fabric with a cotton weft and a linen, silk or hemp warp, one side of which was lightly woolen. Lighter than wool, it became very much in demand, particularly for a new invention: underwear. While linen and hemp could be grown almost anywhere, in the late Middle Ages, cotton came from the Mediterranean region, from Syria, Egypt, Anatolia and Cyprus, and entered Europe via Venice.

From Jacob the Elder to « Fugger Bros »

In Augsburg, Hans had two children: Jacob, known as “Jacob the Elder” (1398-1469) and Andreas Fugger (1394-1457). The two sons had different and opposing investment strategies. While Andreas went bankrupt, Jacob the Elder cautiously expanded his business.

After Jacob the Elder’s death in 1469, his eldest son Ulrich Fugger (1441-1510), with the help of his younger brother Georg Fugger (1453-1506), took over the management of the company.

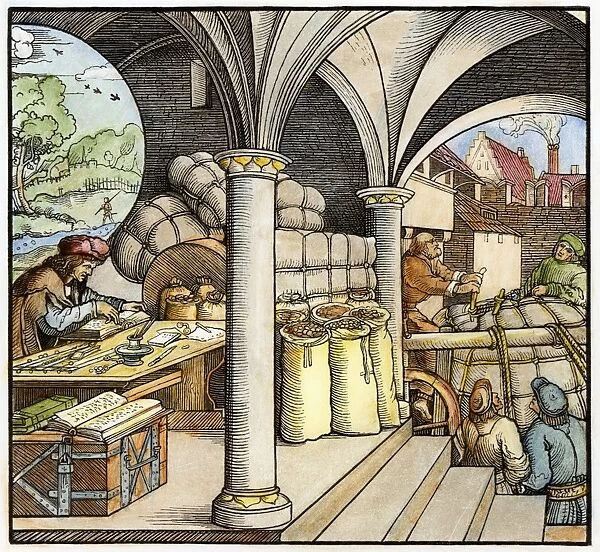

Gradually, profits were invested in far more profitable activities: precious stones, goldsmithery, jewelry and religious relics such as martyrs’ bones and fragments of the cross; spices (sugar, salt, pepper, saffron, cinnamon, alum); medicinal plants and herbs and, above all, metals and mines (gold, silver, copper, tin, lead, mercury) which, as collateral enabled the expansion of credit and monetary issuance.

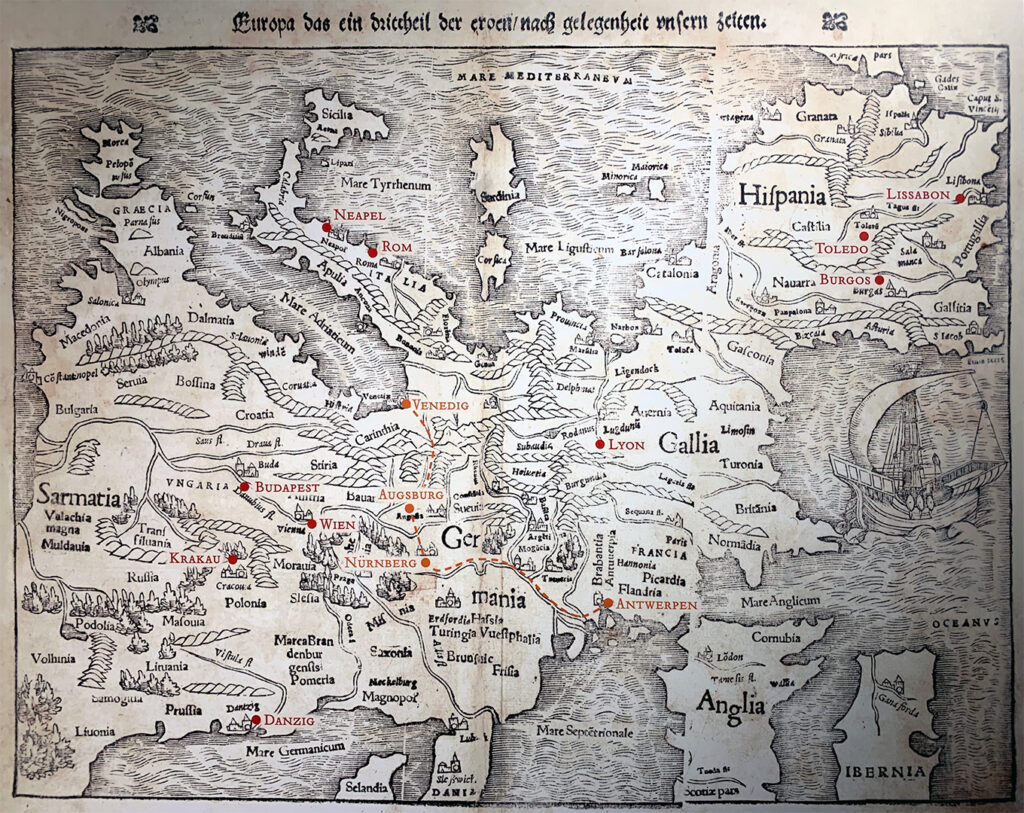

The Fugger forged close personal and professional ties with the aristocracy. They married into some of the most powerful families in Europe – in particular, the Thurzos of Austria. Their activities spread throughout central and northern Europe, Italy and Spain, with branches in Nuremberg, Leipzig, Hamburg, Lübeck, Frankfurt, Mainz and Cologne, Krakow, Danzig, Breslau and Budapest, Venice, Milan, Rome and Naples, Antwerp and Amsterdam, Madrid, Seville and Lisbon.

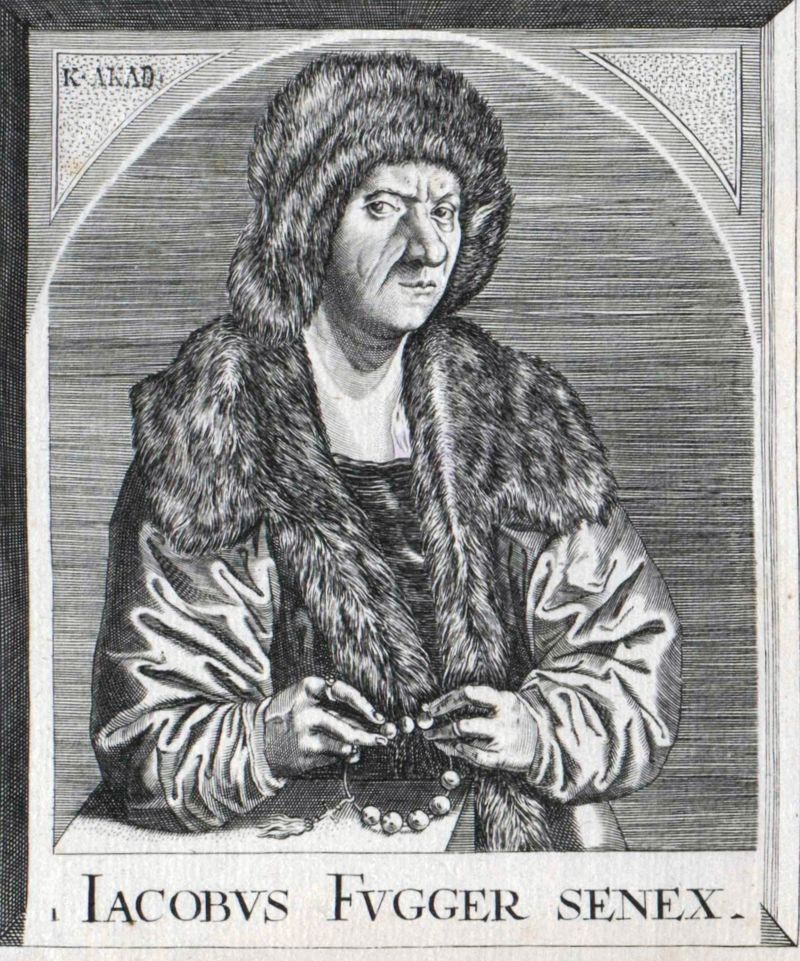

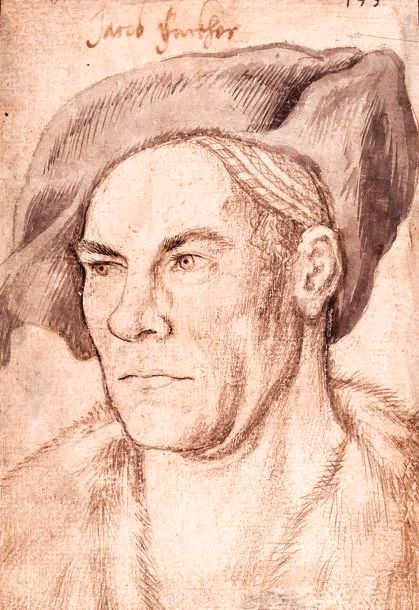

Jacob Fugger « The Rich »

In 1473, another brother, the youngest of the three, Jacob Fugger (later known as “the Rich”) (1459-1525), aged 14 and originally destined for an ecclesiastical career, was sent to Venice, then “the world’s most trading city”. There, he was trained in commerce and book accounting. Jacob returned to Augsburg in 1486 with such admiration for Venice that he liked to be called “Jacobo” and never let go of his Venetian gold beret. Later, with a certain sense of irony, he called the accounting techniques he learned in Venice “The art of enrichment”. The humanist Erasmus of Rotterdam seems to have wanted to respond to him in his colloquium “The friend of lies and the friend of truth”.

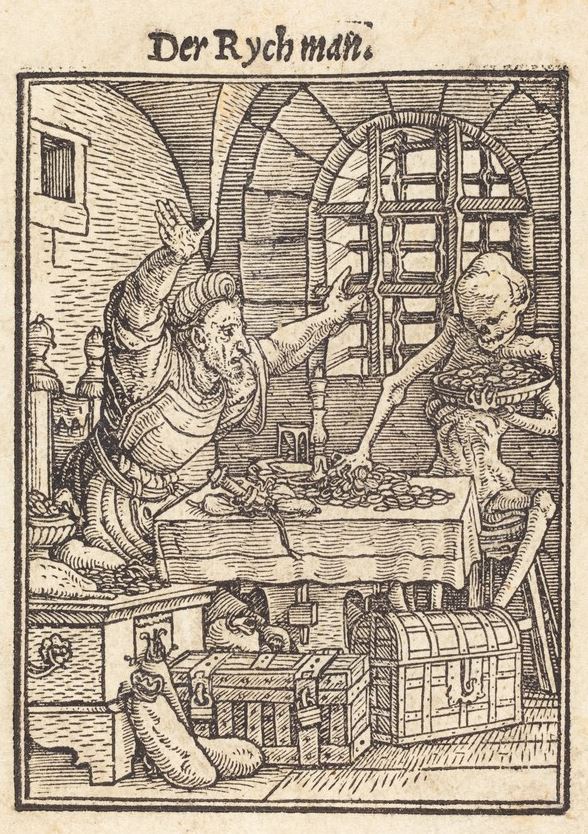

The Banker and his wife

In 1515, Erasmus’ friend in Antwerp, the Flemish painter Quinten Matsys, painted a panel entitled “The Banker and his Wife”, a veritable cultural response from the humanists to the Fuggers. While the banker, who has hung his rosary on the wall behind him, checks whether the metal weight of the coins corresponds to their face value, his wife, turning the pages of a religious book of hours, casts a sad glance at the greedy obsessions of her visibly unhappy husband. The inscription on the frame has disappeared. It read: “Stature justa et aequa sint podere “ (” Let the scales be just and the weights equal”, a phrase taken from the Bible, Leviticus, XIX, 35).

The painter calls out to lawless finance, seeming to say to them: “Which will get you into heaven: the weight of your gold or the weight of your golden deeds, reflection of your love for God?”

The importance of information

In Venice, Jacob assimilated Venetian (Roman Empire) methods to succeed:

- organize a private intelligence service;

- impose a monopoly on strategic goods and products;

- alternate between intelligent corruption and blackmail;

- push the world to the brink of bankruptcy to make bankers such as Fugger indispensable.

Jacob Fugger recognized the importance of information. To be successful, he has to know what’s going on in the seaports and trading centers. Eager to gain every possible business advantage, Fugger set up a private mail courier designed to transmit news — such as “deaths and results of battles” — exclusively to him, so that he would have it before anyone else, especially before the emperor.

Jacob Fugger financed any project, person or operation that meets his long-term objectives. But always under strict conditions set by him, and always to impose himself on others. The prevailing principle was do ut des, in other words, “I give, I can receive”. In exchange for every loan, collateral such as metal production, mining concessions, state financial inflows, commercial and social privileges, tax and customs exemptions, and high positions in key institutions, were demanded. And with the increase in the sums advanced, the increase in the quid pro quos demanded by Fugger.

If “modern” capitalism is the dictatorship of private monopolies at the expense of free competition, it’s safe to say that he truly is its founder.

The most important thing he learned in Venice? To always be prepared to sacrifice short-term financial gains, and even to offer financial profits to his victims, in order to demonstrate his solvency and ensure his long-term political control. In the absence of national or public banks, popes, princes, dukes and emperors depended heavily, if not entirely, on an oligopoly of private bankers. When an Austrian emperor, whose banker he was, wanted to impose a universal tax, Fugger sank the project because it reduced his dependence on bankers!

A Venetian ambassador, discovering that Jacob had learned his trade in Venice, confessed:

“If Augsburg is the daughter of Venice, then the daughter has surpassed her mother”.

Antwerp and Venice

The three Fugger brothers were aware of the key role played by Venice and Antwerp in the copper trade, with Augsburg, along with Nuremberg, right in the middle of the trade corridor connecting them.

Antwerp

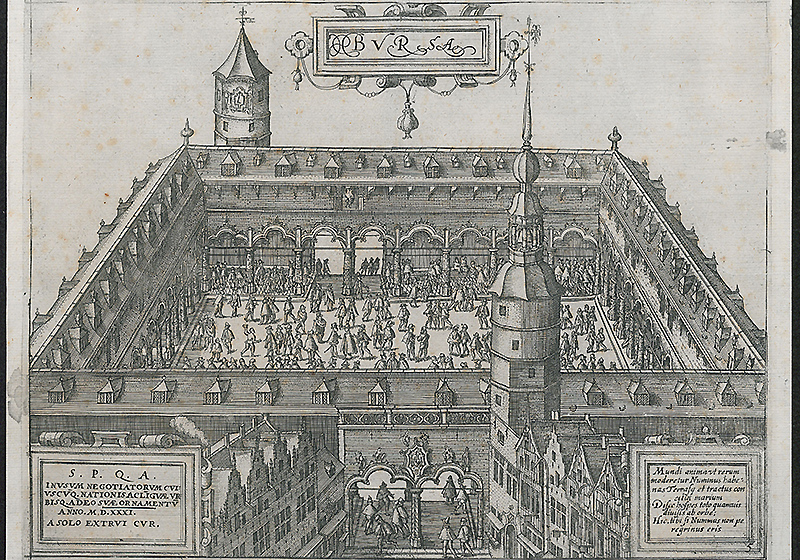

1503 marked the beginning of the Portuguese activities of the House of Fugger in Antwerp, and in 1508 the Portuguese made Antwerp the base of their colonial trade.

In 1515, Antwerp established Europe’s first stock exchange, a model for London (1571) and Amsterdam (1611). Copper, pepper and debts were traded. The purchase of a cargo of pepper was settled ¾ in gold, ¼ in copper. First Venice, then Portugal and Spain, depended on Fugger for silver and copper.

Venice

The firm exported copper and silver from Tyrol to Venice, and imported luxury goods, fine textiles, cotton and, above all, Indian and Oriental spices from Venice. After much effort, on November 30, 1489, the Venetian Council of State confirmed the Fugger’s permanent possession of their room in the “Fondaco dei Tedeschi”, the German merchants’ warehouse on the Grand Canal, on whose upkeep and decoration they spent considerable sums.

At the beginning of the XVIth century, Nuremberg merchants shared with Augsburg merchants the monopoly of what was the most important German trading post. During the meals taken in common, required by the rules, they officially presided over the table with their colleagues from Cologne, Basel, Strasbourg, Frankfurt and Lübeck.

Well-known merchant families traded in the Fondaco dei Tedeschi, including the Imhoff, Koler, Kref, Mendel and Paumgartner families from Nuremberg, and the Fugger and Höchstetter families from Augsburg. Merchants mainly imported spices from Venice: saffron, pepper, ginger, nutmeg, cloves, cinnamon and sugar.

The Nuremberg stock exchange served as a commercial link between Italy and other European economic centers. Foods known and appreciated in the Mediterranean region, such as olive oil, almonds, figs, lemons and oranges, jams and wines like Malvasia and Chierchel found their way from the Adriatic Sea to Nuremberg.

Other valuable products included corals, pearls, precious stones, Murano glassware and textiles such as silk fabrics, cotton and damask sheets, velvet, brocade, gold thread, camelot and bocassin. Paper and books completed the list.

In the years that followed, “Ulrich Fugger & Brothers” dealt in Venetian bills of exchange with the Frankfurt company Blum, and sources frequently mention the company’s branch on the Rialto as an outlet for copper and silver, a center for the purchase of luxury goods and a clearing station for transfers to the Roman curia.

The World changes

In 1498, six years after Christopher Columbus’s voyage to America, Vasco da Gama (1460-1524) was the first European to find the route to India, bypassing Africa. This enabled him to set up Calicut, the first Portuguese trading post in India. The opening of this sea route to the East Indies by the Portuguese deprived the Mediterranean trade routes, and thus South Germany, of much of their importance. Geographically, Spain, Portugal and the Netherlands gained the upper hand.

Jacob Fugger, always in the know before anyone else, decided to adapt to the new realities and relocated his colonial business from Venice to Lisbon and Antwerp. He took advantage of the opportunity to open up new markets such as England, without abandoning markets such as Italy. He took part in the spice trade and opened a factory in Lisbon in 1503. He was authorized to ship pepper, other spices and luxury goods such as pearls and precious stones via Lisbon.

Along with other German and Italian trading houses, Fugger contributed to a fleet of 22 Portuguese ships led by the Portuguese Francisco de Almeida (1450-1510), which sailed to India in 1505 and returned in 1506. Although a third of the imported goods had to be sold to the King of Portugal, the operation remained profitable. Impressed by the financial returns, the King of Portugal made the spice trade a royal monopoly, excluding all foreign participation, in order to reap the full benefits. However, the Portuguese still depended heavily on the copper supplied by Fugger, a key product for trade with India.

Fugger, tricks and tactics

Let’s summarize the “genius” and some of the tricks that enabled Jacob Fugger to become “the rich” at the expense of the rest of humanity.

1. Bail me out, baby

In 1494, the Fugger brothers founded a trading company with a capital of 54,385 florins, a sum that doubled two years later when, in 1496, Jacob persuaded Cardinal Melchior von Meckau (1440-1509), Prince-Bishop of Brixen (today’s Bressanone in the Italian Tyrol), to join the company as a “silent partner” in the expansion of mining activities in Upper Hungary. In total secrecy, and without the knowledge of his ecclesiastical chapter, the prince-Bishop invested 150,000 florins in the Fugger company in exchange for a 5% annual dividend. While such “discreet transactions” were quite common among the Medici, profiting from interest rates remained a sin for the church. When the prince-bishop died in Rome in 1509, this investment scheme was discovered. The pope, the bishopric of Brixen and the Meckau family, all claiming the inheritance, demanded immediate repayment of the sum, which would have led to Jacob Fugger’s insolvency. It was this situation that prompted Emperor Maximilian I to intervene and help his banker. Fugger came up with the formula.

Provided he helped Pope Julius II in a small war against the Republic of Venice, only the Hapsburg monarch was recognized as Cardinal Melchior von Meckau’s legitimate heir. The inheritance could now be settled by paying off outstanding debts. Fugger was also required to deliver jewels as compensation to the Pope. In exchange for his support, however, Maximilian I demanded continued financial backing for his ongoing military and political campaigns. A way of telling the Fugger: “I’m saving you today, but I’m counting on you to save me tomorrow…”.

2. Buy me a pope and the Vatican, baby

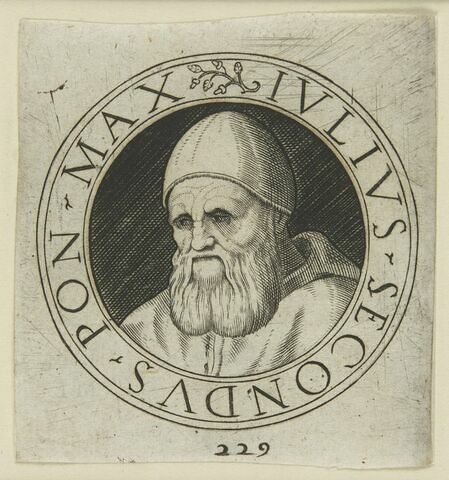

In 1503, Jacob Fugger contributed 4,000 ducats (5,600 florins) to the papal campaign of Julius II and greased the cardinals’ palms to get this “warrior pope” elected. To protect himself and the Vatican, Julius II requested 200 Swiss mercenaries. In September 1505, the first contingent of Swiss Guards set out for Rome. On foot and in the harshness of winter, they marched south, crossed the St. Gotthard Pass and received their pay from the banker… Jacob Fugger.

Julius showed his gratitude by awarding Fugger the contract to mint the papal currency. Between 1508 and 1524, the Fugger leased the Roman mint, the Zecca, manufacturing 66 types of coins for four different popes.

3. Business first, baby

In 1509, Venice was attacked by the armies of the League of Cambrai, an alliance of powerful European forces determined to break Venice’s monopoly over European trade. The conflict disrupted the Fuggers’ land and sea trade. The loans granted by the Fugger to Maximilian (a member of the League of Cambrai) were guaranteed by the copper from the Tyrol exported via Venice… The Fugger’s sided with Venice without falling out with a happy Maximilian.

4. Buy me a hitman, baby

Fugger had rivals who hated him. Among them, the Gossembrot brothers. Sigmund Gossembrot was the mayor of Augsburg. His brother and business partner, George, was Maximilian’s treasury secretary. They wanted mining revenues to be invested in the real economy, and advised the emperor to break with the Fugger. Both brothers died in 1502 after eating black pudding. The great Fugger historian Gotried von Pölnitz, who has spent more time in the archives than anyone else, wonders whether the Fugger ordered the assassination. Let’s just say that absence of proof is not proof of absence.

5. Your mine is mine, baby

The time between 1480 and 1560 was the “century of the metallurgical process.” Gold, silver and copper could now be separated economically. Demand for the necessary mercury for the separation process grew rapidly. Jacob, aware of the potential financial gains it offered, went from textile trade to spice trade and then into mining.

Therefore, he headed to Innsbruck, currently Austria. But the mines were owned by Sigismund Archduke of Austria (1427-1496), a member of the Habsburg family and cousin of the emperor Frederick.

The good news for Jacob Fugger is that Sigismund was a big spender. Not for his subjects, but for his own amusement. One lavish party sees a dwarf emerge from a cake to wrestle a giant.

As a result, Sigismund was constantly in debt. When he ran out of money, Sigismund sold the production from his silver mine at knock-down prices to a group of bankers. To the Genoese banking family Antonio de Cavallis, for example. To get into the game, Fugger lends the Archduke 3,000 florins and receives 1,000 pounds of silver metal at 8 florins per pound, which he later sells for 12. A paltry sum compared with those lent by others, but a key move that opened his relations with Sigismund and above all with the nascent Habsburg dynasty.

In 1487, after a military skirmish with the more powerful Venice for control of the Tyrolean silver mines, Sigismund’s financial irresponsibility made him persona non grata with the big bankers. In despair, he turned to Fugger. Fugger mobilized the family fortune to raise the money the archduke demanded. An ideal situation for the banker. Of course, the loan was secured and subject to strict conditions. Sigismund was forbidden to repay it with silver metal from his mines, and had to cede control of his treasury to Fugger. If Sigmund repays him, Fugger walks away with a fortune. But, given Sigmund’s track record, the chance of him repaying is nil. Ignoring the terms of the loan, most of the other bankers are convinced that Fugger will go bankrupt. And indeed, Sigismund defaulted, just as Fugger… had predicted. However, as stipulated in the contract, Fugger seized “the mother of all silver mines”, the one in the Tyrol. By advancing a little cash, he gets his hands on a giant silver mine.

6. Buy my « Fugger Bonds », baby

The way Fugger banking worked was that Fugger lent to the emperor (or another customer) and re-financed the loan on the market (at lower interest rates) by selling so-called “Fugger bonds” to other investors. The Fugger bonds were much sought after investments as the Fugger were regarded as “safe debtors”. Thus, the Fugger used their own superior credit standing in the market to secure financing for their customers whose credit rating was not as well regarded. The idea was – provided the emperor and the other customers honored their commitments – they would make a profit from the difference in interest between the loans the Fugger extended and the interest payable on the Fugger bonds.

7. Buy me an Emperor, baby

Sigismund was soon eclipsed by emperor Frederick IIIrd’s son, Maximilian of Austria (1459-1519), who had arranged to take power if Sigismund did not pay back money he owed him. (Fugger could have lent Sigismund the money to keep him in power but decided he’d prefer Maximilian in the position.)

Maximilian was elected “King of the Romans” in 1486 and ruled as the Holy Roman Emperor from 1508 till his death in 1519. Jacob Fugger supported Maximilian I of Habsburg in his accession to the throne by paying 800,000 florins. Laying the foundation for the family’s widely distributed landholdings, this time Fugger, as collateral, didn’t want silver, but land. So he acquired the countships of Kirchberg and Weissenhorn from Maximilian I in 1507 and in 1514, the emperor made him a count.

Unsurprisingly, Maximilian’s military conquests coincided with Jacob’s plans for mining expansion. Fugger purchased valuable land with the profits from the silver mines he had obtained from Sigismund, and then financed Maximilian’s army to retake Vienna in 1490. The emperor also seized Hungary, a region rich in copper.

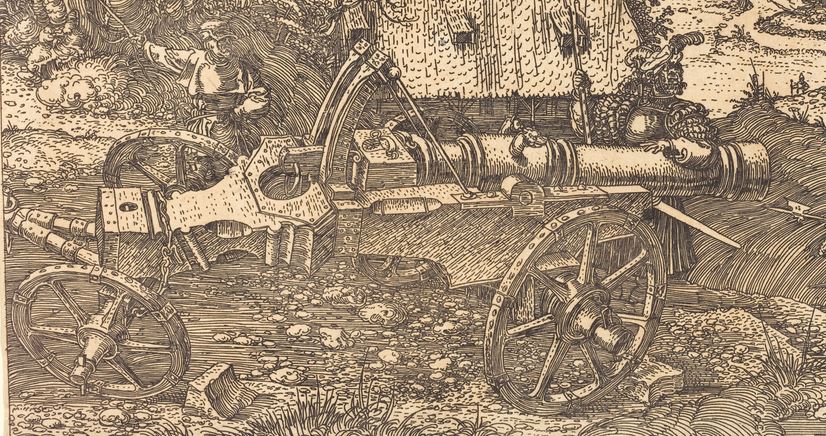

A “copper belt” stretched along the Carpathian Mountains through Slovakia, Hungary and Romania. Fugger modernizes the country’s mines by introducing hydraulic power and tunnels. Jacob’s aim was to establish a monopoly on this strategic raw material, copper ore. Along with tin, copper is used in the manufacture of bronze, a strategic metal for weapons production. Fugger opened foundries in Hohenkirchen and Fuggerau (the family’s namesake in Carinthia, today in Austria), where he produced cannons directly.

8. Sell me indulgences, baby

In 1514, the position of Archbishop of Mainz became available. As we have seen, this was the most powerful position in Germany, with the exception of that of the emperor. Such positions require remuneration. Albrecht of Brandenburg (1490-1545), whose family, the Hohenzollerns, ruled a large part of the country, wanted the post. Albrecht was already a powerful man: he held several other ecclesiastical offices. But even he couldn’t afford to pay such high fees. So, he borrowed the necessary sum from the Fugger, in return for interest, which the convention of the time described as a fee for “trouble, danger and expense”.

Pope Leo X, having squandered the papal treasury on his coronation and organized parties where prostitutes looked after the cardinals, asked for 34,000 florins to grant Albrecht the title – roughly equivalent to $4.8 million today – and Fugger deposited the money directly into the pope’s personal account.

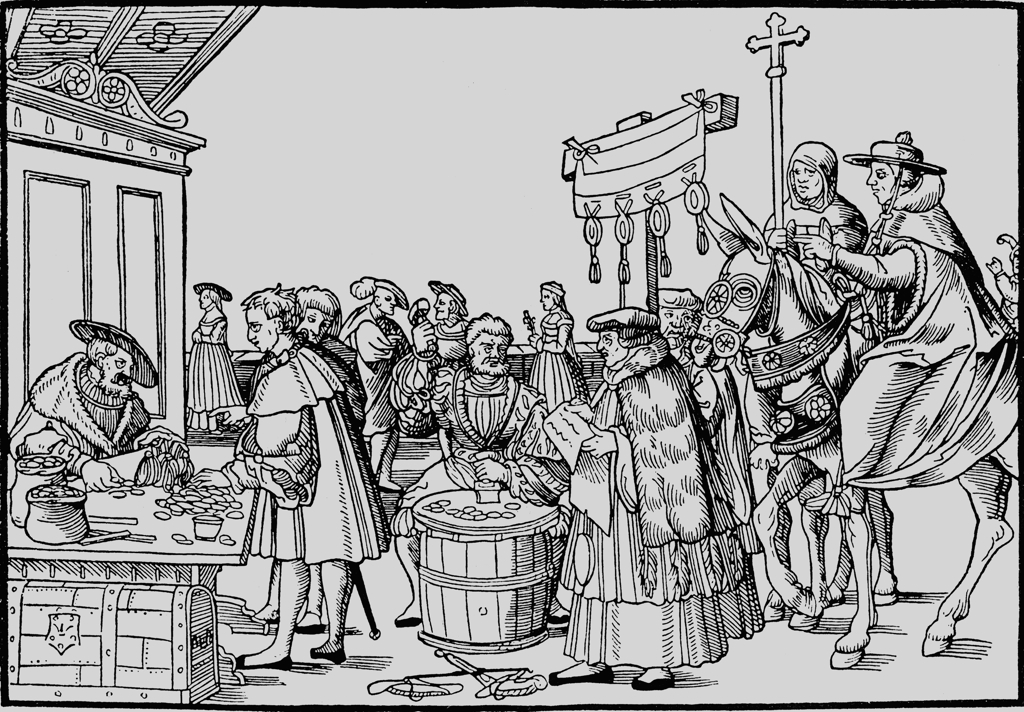

All that remained was to pay back the Fugger. Albrecht had a plan. He obtained from Pope Leo X the right to administer the recently announced “jubilee indulgences”. Indulgences were contracts sold by the Church to forgive sins, allowing believers to buy their way out of purgatory and into heaven.

But to fleece the sheep, as with any good scam, a “cover” or “narrative” was required. The motive, concocted by Julius II, was credible, claiming that St. Peter’s Basilica needed urgent and costly renovation.

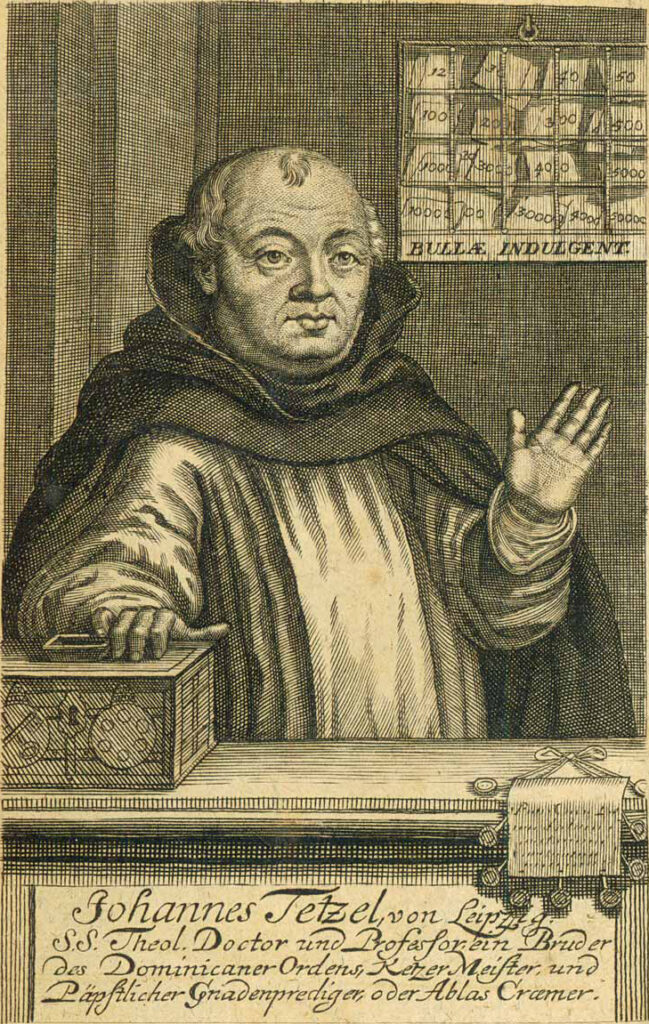

In charge of the sale was a “peddler of indulgences”, the Dominican Johann Tetzel, who “carried Bibles, crosses and a large wooden box with […] an image of Satan on top”, and told the faithful that his indulgences “canceled all sins”. He even proposed a “progressive scale”, with the wealthy believers paying 25 florins and ordinary workers just one. Tetzel is quoted as saying: “When the money rattles in the box, the soul jumps out of purgatory”.

On the ground, in every church, Fugger clerks worked on site to collect the money, half of which went to the Pope and half to Fugger. At the same time, Fugger obtained a monopoly on the transfer of the funds obtained from the sale of indulgences between Germany and Rome.

If the archbishop was at the mercy of the Fugger, so too was Pope Leo X, who, to repay his debt, collected money through “simonies”, i.e. selling high ecclesiastical offices to princes. Between 1495 and 1520, 88 of the 110 bishoprics in Germany, Hungary, Poland and Scandinavia were appointed by Rome in exchange for money transfers centralized by Fugger. In this way, Fugger became “God’s banker, Rome’s chief financier”.

9. Buy me Martin Luther, baby

Since the IIIrd century, the Catholic Church asserted that God can be indulgent, granting total or partial remission of the penalty incurred following forgiveness of a sin. However, the indulgence obtained in return for an act of piety (pilgrimage, prayer, mortification, donation), notably in order to shorten a deceased person’s passage through purgatory, over time, turned into a lucrative business, used by Urban II to recruit enthusiastic faithful to the First Crusade.

In the XVIth century, it was this trade in indulgences that led to serious unrest and turmoil within the Church. Described as superstition by Erasmus in his “In Praise of Folly”, the denunciation of the indulgence trade was the very subject of Luther’s ninety-five arguments, the manifesto he nailed on the door of the Castle Church of Wittenberg and would lead the Church to division and to the Protestant Reformation. Refusing to travel to Rome to answer charges of heresy and of challenging the Pope’s authority, Luther agreed to present himself in Augsburg in 1518 to the papal legate, Cardinal Cajetan. The latter urged Luther to retract or reconsider his statements (“revoca!”).

Although Luther had denounced Fugger by name for his central role in the indulgence swindle, he agreed to be interrogated in the central office of the bank that organized the crime he denounced!

Luther seems to have been aware that, verbal accusations aside, the Fuggers would protect and promote him rather than face a much more reasonable call for reform from Erasmus and his followers. While he could have been arrested and burned at the stake as some demanded, Luther showed up, refused to backtrack on his statements and left unscathed.

10. Buy them poverty, baby

In the XVIth century, prices increased consistently throughout Western Europe, and by the end of the century prices reached levels three to four times higher than at the beginning. Recently historians have grown dissatisfied with monetary explanations of the sixteenth-century price rise. They have realized that prices in many countries began to rise before much New World gold and silver entered Spain, let alone left it, and that probable treasure-flows bear little relation to price movements, including in Spain itself.

In reality, in the late fifteenth and early sixteenth century European populations began to expand again, recovering from that long era of contraction initiated by the Black Death of 1348. Growing populations produced rising demands for food, drink, cheap clothing, shelter, firewood, etc., all ultimately products of the land. Farmers found it difficult to increase their output of these things: food prices, land values, industrial costs, all rose. Such pressures are now seen as an important underlying cause of this inflation, though few would deny that it was stimulated at times by governments manipulating the currency, borrowing heavily, and fighting wars.

The “Age of the Fuggers” was an age where money was invested in more money and financial speculation. The real economy was looted by taxes and wars.

The dynamic created by the collapse of the living standards, taxes and price inflation for most of the people and the public exposure of corruption of both the Church and the aristocracy, set the scene for riots in many cities, the German “Peasant war,” an insurrection of weavers, craftsmen and even miners, ending with the “Revolt of the Netherlands” and centuries of bloody “religious” wars that only terminated with the “funeral” of the Empire by the Peace of Westphalia in 1648.

11. Buy them social housing, baby

Jacob Fugger’s initiative, in 1516, to start building the Fuggerei, a social housing project for a hundred working families in Augsburg, rather unique for the day, came as “too little and too late,” when the firm’s image became under increasing attacks. The Fuggerei survived as a monument to honor the Fugger. The rent remained unchanged, it still is one Rhenish gulden per year (equivalent to 0.88 euros), three daily prayers for the current owners of the Fuggerei, and the obligation to work a part-time job in the community. The conditions to live there, akin to the Harz4 measures, remain the same as they were 500 years ago: one must have lived at least two years in Augsburg, be of the Catholic faith and have become indigent without debt. The five gates are still locked every day at 10 PM.

12. Buy me rates worth an interest, baby

“You shall not charge interest.” In 1215 Pope Innocent III explicitly confirmed the prohibition on interest and usury decreed in the Bible. The line from Luke 6:35, “Lend and expect nothing in return,” was taken by the Church to mean an outright ban on usury, defined as the demand for any interest at all. Even savings accounts were considered sinful. Not Jacob Fugger’s ideal scenario. To change this, Fugger hired a renowned theologian Johannes Eck (1494-1554) of Ingolstadt to argue his case. Fugger conducted a full-on public relations campaign, including setting up debates on the issue, and wrote an impassioned letter to Pope Leo.

As a result, Leo issued a decree proclaiming that charging interest was usury only if the loan was made “without labor, cost or risk” — which of course no loan ever really is. More than a millennium after Aristotle, Pope Leo X found that risk and labor involved with safeguarding capital made money lending “a living thing.” As long as a loan involved labor, cost, or risk, it was in the clear. This opened a flood of church-legal lending: Fugger’s lobbying paid off with a fortune. Fugger persuaded the Church to permit an interest of 5% – and he was reasonably successful: charging interest was not allowed, but it wasn’t punished either.

Thanks to Leon X, Fugger was now able to attract cash by offering depositors a 5% return. As for loans, according to the Tyrolean Council’s report, while other bankers were lending Maximilian at a rate of 10%, the rate charged by Fugger, justified by “the risk”, was over 50%! Charles V, in the 1520s, had to borrow at 18%, and even at 49% between 1553 and 1556. Meanwhile, Fugger’s equity, which in 1511 amounted to 196,791 florins, rose in 1527, two years after Jacob’s death, to 2,021,202 florins, for a total profit of 1,824,411 florins, or 927% increase, which represents, on average, an annual increase of 54.5%.

All this is presented today, not as usury, but as a “great advance” anticipating modern wealth and asset management practices…

Fugger “broke the back of the Hanseatic Ligue” and “roused commerce from its medieval slumber by persuading the pope to lift the ban on moneylending. He helped save free enterprise from an early grave by financing the army that won the German Peasants War, the first great clash between capitalism and communism,” writes Greg Steinmetz, historian and former Wall Street Journal correspondent.

Why Venice created the ghetto for Jewish bankers

Of course, for a long time, the Venetians ignored these rules as they preferred making money to pleasing God, entombed in the motto, we are “First Venetians, then Christians.”

In 1382, Jews were allowed to enter Venice. In 1385 the first “Condotta” was granted, an agreement between the Republic of Venice and Jewish bankers, which gave them permission to settle in Venice to lend money at interest. The 10-year agreement detailed the rules that these bankers had to follow. Among others, it established the high annual tax to be paid, the number of banks that could open and the interest rates they could charge.

In 1385, Venice signed another agreement with Jewish bankers who lived in Mestre, located on dry land opposite the islands of Venice, so that they could grant loans at favorable rates to the poorest sections of the city. With this agreement, Serenissima managed to alleviate the poverty of the population and, at the same time, if people got angry against the Doge, could direct the hostility of the masses against Jewish moneylenders.

The Condotta of 1385, was not renewed in 1394 under the pretext that the Jews were not following the rules imposed on their activities. Jewish bankers received permission to stay for a period of 15 days a month and those who lived in Mestre used this concession to work in Venice. But to be recognized as Jews, they were already obliged to wear a yellow circle on their clothing…

To make a long story short, Venice resolved the “dilemma” by opting for mass segregation. On March 20, 1516, one of the members of the Council, after violently attacking the Jews verbally, asked that they be confined in the “Ghetto” a Venetian dialect word, used at the time to refer to the foundries in the area. The Doge and Council approved the solution. If they wanted to continue to live in Venice, Jews would have to live together in a certain area, separated from the rest of the population. On March 29, a decree created the Venice Ghetto.

You can read here the full story of the Venice ghetto

13. Buy me an Austro-Hungarian empire, baby

When Turkey invaded Hungary in 1514, Fugger was gravely concerned about the value of his Hungarian copper mines, his most profitable properties. After diplomatic efforts failed, Fugger gave Maximilian an ultimatum — either strike a deal with Hungary or forget about more loans. The threat worked. Maximilian negotiated a marriage alliance that left Hungary in Hapsburg hands, leading to “redrawing the map of Europe by creating the giant political tinderbox known as the Austro-Hungarian Empire. Fugger needed a Hapsburg seizure of Hungary to protect his holdings.

14. Buy me a second emperor, baby

When Maximilian I, Holy Roman Emperor, died in 1519, he owed Jacob Fugger around 350,000 guilders. To avoid a default on this investment, Fugger organized a banker’s rally to gather all the bribery money allowing Maximilian’s grandson, Charles V, buying the throne.

If another candidate had been elected emperor, like King Francis I of France who suddenly tried to enter the scene, and would certainly have been reluctant to pay Maximilian’s debts to Fugger, the latter would have sunk into bankruptcy.

This situation reminds the modus operandi of JP Morgan, after the 1897 US banking crash and the banking panic of 1907. The “Napoleon of Wall Street,” afraid of a revival of a real national bank in the tradition of Alexander Hamilton, first gathered all the funds required to bail out his failing competitors, and then set up the Federal Reserve system in 1913, a private syndicate of bankers in charge of preventing the government of interfering in their lucrative business

Hence, Jacob Fugger, in direct liaison with Margaret of Austria, who bought into the scheme because of her worries about peace in Europe, in a totally centralized way, gathered the money for each elector, using the occasion to bolster dramatically his monopolistic positions, especially over his competitors such as the Welsers and the rising port of Antwerp.

According to the French historian Jules Michelet (1798-1874), Jacob Fugger energetically imposed three preconditions:

- “The Garibaldi of Genoa, the Welsers of Germany and other bankers, could only partake in this scheme by making down-payments to Fugger and could only lend money [to Charles] through his intermediary;

- “Fugger obtained promissory notes from the cities of Antwerp and Mechelen as collateral, paid for out of Zeeland tolls;

- “Fugger got the city of Augsburg to forbid lending to the French. He requested Marguerite of Austria (the regent) to forbid the people of Antwerp from exchanging money in Germany for anyone.” (handing over de facto that lucrative business to the Augsburg bankers only…)

Now, as said before, people mistakenly think that Jacob “the Rich”, was “very rich.” Of course he was: today, he is considered to be one of the wealthiest people ever to have lived, with a GDP-adjusted net worth of over $400 billion, and approximately 2% of the entire GDP of Europe at the time, more than twice the fortune of Bill Gates.

If this was true or not and how wealthy he really was we will never know. But if you look at the capital declared by the Fugger brothers to the Augsburg tax authorities, it dwarfs by far the giant amounts being lent.

According to Fugger historian Mark Häberlein, Jacob anticipated modern day tax avoidance tricks by striking a deal with the Augsburg tax authorities in 1516. In exchange for an annual lump sum, the family’s true wealth… would not be disclosed. One of the reasons of course is that, just as BlackRock today, Fugger was a “wealth manager”, promising a return on investment of 5 percent while pocketing 14.5 percent himself… Cardinals and other fortunes would secretly invest in Fugger for his juicy returns.

Hence, it is safe to say that Fugger was very rich… of debts. And just as the IMF and a handful of mammoth banks today, by bailing out their clients with fictitious money, the Fuggers were doing nothing else than bailing out themselves and increasing their capacity to keep doing so. No structural reform on the table, only a liquidity crisis? Sounds familiar!

Charles’ unanimous selection by the Electors required exorbitant bribes, to the tune of 851,585 guilders, to smooth the way. Jacob Fugger put in 543,385 guilders, around two thirds of the sum. For the first time, the only collateral was Charles himself, ruling over most of the world and America.

It would take an entire book or a documentary to detail the amazing scope of bribes deployed for Charles’ imperial election, a well-documented event.

Just some excerpts from a detailed account:

“Cardinal Albert of Brandenburg, Elector of Mainz, received 4,200 gold florins for his attendance at the Diet of Augsburg. In addition, Maximilian undertook to pay him 30,000 florins, as soon as the other electors had also committed themselves to give their votes to the Catholic King (Charles V). This was a bonus granted to the cardinal of Mainz for being the first to pledge his vote; to this gift was to be added a gold credence and a tapestry from the Netherlands. The greedy elector would also receive a life pension of 10,000 Rhine florins, payable annually in Leipzig at the Fugger bankers’ counter, and guaranteed by [the cash flow of taxes raised on maritime trade by] the cities of Antwerp and Mechelen. Finally, the Catholic King (Charles V) had to protect him to against the resentment of the King of France and against any other aggressor, while insisting that Rome grant him the title and prerogatives of ‘legate a latere’ in Germany, with the appointment benefits.”

“Hermann de Wied, archbishop-elector of Cologne, had received 20,000 florins in cash for himself and 9,000 florins to be shared between his principal officers. He was also promised a life pension of 6,000 florins, a life pension of 600 florins for his brother, a perpetual pension of 500 florins for his other brother, Count Jean, and brother, Count Jean, as well as other pensions amounting to 700 florins, to be among his principal officers.”

“For his part, Joachim I Nestor, Elector and Margrave of Brandenburg (another Hohenzollern and brother of Albert of Brandenburg), demanded substantial compensation for the advantages he was losing by abandoning the French king. The latter had promised him a princess of royal blood for his son and a large sum of money. Joachim was therefore keen to replace Renée de France with Princess Catherine, Charles’s sister, and demanded 8,000 florins for himself and 600 for his advisors. And that wasn’t all. He was to be paid in cash on the day of the election: 70,000 florins to deduct from Princess Catherine’s dowry; 50,000 florins for the election; 1,000 florins for his chancellor and 500 florins for his advisor, Dean Thomas Krul.”

15. Buy me zero regulation, baby

In 1523, under pressure from public opinion growing angry against the merchant houses of Augsburg, foremost of them the Fugger, the fiscal arm of the imperial Council of Regency brought an indictment against them. Some even brought up the idea of restricting trading capital of individual firms to 50,000 florins and limiting the number or their branches to three.

Acutely aware that such regulations would ruin him, Jacob Fugger, in panic, on April 24, 1523, wrote a short message to the Emperor Charles V, remembering his Majesty of his dependence on the good health of the Fugger bank accounts:

“It is furthermore no secret that Your Imperial Majesty would not have obtained the crown of Rome without my help, as I can prove from letters written in their own hand by all Your Majesty’s commissioners (…) Your Majesty still owes me 152,000 ducats, etc.”

Charles Vth realized that the debt was not the issue of the message and immediately wrote to his brother Ferdinand, asking him to take measures to prevent the anti-monopoly trial. The imperial fiscal authorities were ordered to drop the proceedings. For Fugger and the other great merchants, the storm had passed.

16. Buy me Spain, baby

Of course, Charles V didn’t had a dime to pay back the giant Fugger loan that got him elected! Little by little, Fugger obtained his rights to continue mining metals – silver and copper – in the Tyrol, validated. But he got more, first in Spain itself and, quite logically, in the territories newly conquered by Spain in America.

17. Buy me America, baby

Firstly, to raise funds, Charles leased the income of the main territories of the three great Spanish orders of chivalry, known as Maestrazgos, for which the Fugger paid 135,000 ducats a year but got much more than what he spent for the lease.

Between 1528 and 1537, the Maestrazgos were administered by the Welsers of Augsburg and a group of merchants led by the Spanish head of the postal service Maffeo de Taxis and the Genoese banker Giovanni Battista Grimaldi. But after 1537, the Fugger took over again. The lease contract was very attractive for two reasons: first it allowed the leaseholders to export grain surpluses from these estates and second, it included the mercury mines of Alamadén, a crucial element both for the production of mirror glass, the processing of gold and medical applications.

Now, as the Fugger depended on gold and silver shipments from America to recover their loans to the Spanish crown, it appeared logical for them to set their eyes on the New World, as well.

18. Buy me Venezuela, baby

Let us now enter the Welsers whose history can be traced back to the XIIIth century, when its members held official positions in the city of Augsburg. Later, the family became widely known as prominent merchants. During the XVth century, when the brothers Bartholomew and Lucas Welser carried on an extensive trade with the Levant and elsewhere, they had branches in the principal trading centers of southern Germany and Italy, and also in Antwerp, London, and Lisbon. In the XVth and XVIth centuries, branches of the family settled at Nuremberg and in Austria.

As a reward for their financial contributions to his election in 1519, second in importance to Fugger but quite massive, King Charles V, unable to reimburse, provided the Welsers with privileges within the African slave trade and conquests of the Americas.

The Welser Family was offered the opportunity to participate in the conquest of the Americas in the early to mid-1500s. As fixed in the Contract of Madrid (1528), also known as the “Welser Contracts”, the merchants were guaranteed the privilege to carry out so-called “entradas” (expeditions) to conquer and exploit large parts of the territories that now belong to Venezuela and Colombia. The Welsers nourished fantasies about fabulous riches fueled by the discovery of golden treasures and are said to have created the myth of “El Dorado” (the city of gold).

The Welsers started their operations by opening an office on the Portuguese island of Madeira and acquiring a sugar plantation on the Canary Islands. Then they expanded to San Domingo, today’s Haiti. The Welser’s hold of the slave trade in the Caribbean began in 1523, five years before the Contract of Madrid, as they had begun their own sugar production on the Island.

Included in the Contract of Madrid, the right to exploit a huge part of the territory of today’s Venezuela (Klein Venedig, Little Venice), a country they themselves called “Welserland”. They also obtained the right to ship 4,000 African slaves to work in the sugar plantations. While Spain would grant capital, horses and arms to Spanish conquistadors, the Welser would only lend them the money that allowed them to buy, exclusively from them, the means of running their operations.

Poor German miners went to Venezuela and got rapidly into huge debt, a situation which exacerbated their rapacity and worsened the way they treated the slaves. From 1528 to 1556, seven expeditions led to the plunder and destruction of local civilizations. Things became so ugly that in 1546, Spain revoked the contract, also because they knew the Welsers also served Lutheran clients in Germany.

Bartholomeus Welser’s son, Bartholomeus VI Welser, together with Philipp von Hutten were arrested and beheaded in El Tocuyo by local Spanish Governor Juan de Carvajal in 1546. Some years later, the abdication of Charles V in 1556 meant the definitive end of the Welser’s attempt to re-assert their concession by legal means.

19. Buy me Peru and Chile, baby

Unlike the Welser family, Jacob Fugger’s participation in overseas trade was cautious and conservative, and the only other operation of this kind he invested in, was a failed 1525 trade expedition to the Maluku Islands led by the Spaniard Garcia de Loaisa (1490-1526).

For Spain, the idea was to gain access to Indonesia via America, escaping Portuguese control over the spice road. Jacob the Rich died in December of that year and his nephew Anton Fugger (1493-1560) took over the strategic management of the firm.

And the did go on. The Fugger’s relations with the Spanish Crown reached a climax in 1530 with the loan of 1.5 million ducats from the Fugger for the election of Ferdinand as “Roman King”. It was in this context that the Fugger agent Veit Hörl obtained as collateral from Spain the right to conquer and colonize the western coastal region of South America, from Chincha to the Straits of Magellan. This region included present-day southern Peru and all of Chile. Things however got foggy and for unknown reasons, Charles V, who in principle agreed with the deal failed to ratify the agreement. Considering that the Welser’s Venezuela project degenerated into a mere slave-raiding and booty enterprise and ended in substantial losses, Anton Fugger, who thought financial returns were too low, abandoned the undertaking.

20. By me a couple of slaves, baby

Copper from the Fugger mines was used for cannons on ships but also ended up in the production of horse-shoe shaped “manillas”. Manillas, derived from the Latin for hand or bracelet, were a means of exchange used by Britain, Portugal, Spain, the Netherlands, France and Denmark to trade with west Africa in gold and ivory, as well as enslaved people. The metals preferred were originally copper, then brass at about the end of the XVth century and finally bronze in about 1630.

In 1505, in Nigeria, a slave could be bought for 8–10 manillas, and an elephant’s ivory tooth for one copper manila. Impressive figures are available: between 1504 and 1507, Portuguese traders imported 287,813 manillas from Portugal into Guinea, Africa, via the trading station of São Jorge da Mina. The Portuguese trade increased over the following decades, with 150,000 manillas a year being exported to the like of their trading fort at Elmina, on the Gold Coast. An order for 1.4 million manillas was placed, in 1548, with a German merchant of the Fugger family, to support the trade.

In clear: without the copper of the Fugger’s, the slave-trade would not never have become what it became.

In 2023, a group of scientists discovered that some of the Benin bronzes, now reclaimed by African nations, were made with metal mined thousands of miles away… in the German Rhineland. The Edo people in the Kingdom of Benin, created their extraordinary sculptures with melted down brass manilla bracelets, Fugger’s grim currency of the transatlantic slave trade between the XVIth and XIXth centuries…

Endgame

Anton Fugger tried to maintain the position of a house that, however, continued to weaken. Sovereigns were not as solvent as had been hoped. Charles V had serious financial worries and the looming bankruptcy was one of the causes he stepped down leaving the rule of the empire to his son, King Philip II of Spain. Despite all the gold and silver arriving, the Empire went bankrupt. On three occasions (1557, 1575, 1598), Philip II was unable to pay his debts, as were his successors, Philip III and Philip IV, in 1607, 1627 and 1647.

But the political grip of the Fugger over Spanish finances was so strong, writes Jeannette Graulau, that “when Philip II declared a suspension of payment in 1557, the bankruptcy did not include the accounts of the Fugger family. The Fugger offered Philip II a 50 % reduction in the interest of the loans if the firm was omitted from the bankruptcy. Despite intense lobbying by his powerful secretary, Francisco de Eraso, and Spanish bankers who were rivals of the Fugger, Philip did not include the Fugger in the bankruptcy.”

In 1563, the Fugger’s’ claims on the Spanish Crown amounted to 4.445 million florins, far more than their assets in Antwerp (783,000 florins), Augsburg (164,000 florins), Nuremberg and Vienna (28,600 florins), while their total assets amounted to 5.661 million florins.

But in the end, having tied their fate too closely to that of the Spanish sovereigns, the Fugger banking Empire collapsed with the collapse of the Spanish Hapsburg Empire. The Welser went belly up in 1614.

French professor Pierre Bezbakh, writing in Le Monde in Sept. 2021 noted:

“So when the coffers were empty, the Spanish kingdom issued loans, a practice that was not very original, but which became recurrent and on a large scale. These loans were underwritten by foreign lenders, such as the German Fugger and Genoese bankers, who accumulated but continued to lend, knowing they would lose everything if they stopped doing so, just as today’s big banks continue to lend to over-indebted states. The difference is that lenders were waiting for the promised arrival of American metals, whereas today, lenders are waiting for other countries or central banks to support countries in difficulty.”

Today, a handful of international banks called “Prime Brokers” are allowed to buy and resell on the secondary market French State Bonds, issued at regular dates by the French Treasury Agency to refinance French public debt (€3,150 billion) and most importantly to refinance debt repayments (€41 billion in 2023).

The names of today’s Fugger are: HSBC, BNP Paribas, Crédit Agricole, J.P. Morgan, Société Générale, Citigroup, Deutsche Bank, Barclays, Bank of America Securities and Natixis.

Conclusion

Beyond the story of the Fugger and Welser dynasties who, after colonizing Europeans, extended their colonial crimes to America, there’s something deeper to understand.

Today, it is said that the world financial system is “hopelessly” bankrupt. Technically, that is true, but politically it is successfully kept on the border of total collapse in order to keep the entire world dependent on a stateless financier predator class. A bankrupt system, paradoxically, despairs us, but gives them hope to remain in charge and maintain their privileges. Only bankers can save the world from bankruptcy!

Historically, we, as one humanity, have created “Nation States” duly equipped with government controlled “National Banks,” to protect us from such systemic financial blackmail. National Banks, if correctly operated, can generate productive credit generation for our long-term interest in developing our physical and human economy rather than the financial bubbles of the financial blackmailers. Unfortunately, such a positive system has rarely existed and when it existed it was shot down by the money-traders Roosevelt wanted to chase from the temple of the Republic.

As we have demonstrated, the severe mental dissociation called “monetarism” is the essence of (financial) fascism. Criminal financial and banking syndicates “print” and “create” money. If that money is not “domesticated” and used as an instrument for increasing the creative powers of mankind and nature, everything cannot, but go wrong.

Willing to “convert”, at all cost, including by the destruction of mankind and his creative powers, a nominal “value” that only exists as an agreement among men, into a form of “real” physical wealth, was the very essence of the Nazi war machine.

In order to save the outstanding debts of the UK and France to the US weapon industry owned by JP Morgan and consorts, Germany had to be forced to pay. When it turned out that was impossible, Anglo-French-American banking interests set up the “Bank for International Settlements”.

The BIS, under London’s and Wall Street’s direct supervision, allowed Hitler to obtain the Swiss currency he required to go shopping worldwide for his war machine, a war machine considered potentially useful as long as it was set to march East, towards Moscow. As a collateral for getting cash from the BIS, the German central bank would deposit as collateral tons of gold, stolen from countries it invaded (Austria, Netherlands, Belgium, Luxembourg, Czechoslovakia, Poland, Albania, etc.). The dental gold of the Jews, the communists, the homosexuals and the Gypsies being exterminated in the concentration camps, was deposited on a secret account of the Reichsbank to finance the SS.

The Bank of England’s and Hitler’s finance minister Hjalmar Schacht, who escaped the gallows of the Nuremberg trials thanks to his international protections, was undoubtedly the best pupil ever of Jacob Fugger the Rich, not the father of German or “modern” banking, but the father of financial fascism, inherited from Rome, Venice and Genoa. Never again.

Summary biography

- Steinmetz, Greg, The Richest Man Who Ever Lived, The Life and Times of Jacob Fugger, Simon and Shuster, 2016 ;

- Cohn, Henry J., Did Bribes Induce the German Electors to Choose Charles V as Emperor in 1519?

- Herre, Franz, The Age of the Fuggers, Augsbourg, 1985 ;

- Montenegro, Giovanna, German Conquistadors in Venezuela: The Welsers’ Colony, Racialized Capitalism, and Cultural Memory,

- Ehrenberg, Richard, Capital et finance à l’âge de la Renaissance : A Study of the Fuggers, and Their Connections, 1923,